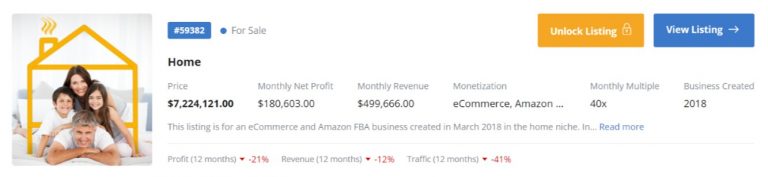

Note that buyers are very picky, and they will ask about every fluctuation in your P&L.

For that reason, make sure you are able to explain any trends present in your Income Statement. If you can’t explain them, the buyer will assume the worst and assume there’s something fundamentally wrong with your brand, even when that might not be the case.

For Example: Your profit margins decreased for 3 months straight because you outsourced your Advertising to a bad marketing agency. They increased your marketing costs without increasing Revenue.

If a situation like this happens to you, be upfront about it. Depending on how good your financials are, the buyer can see it as a positive since it will be easier to beat your numbers in the following years.

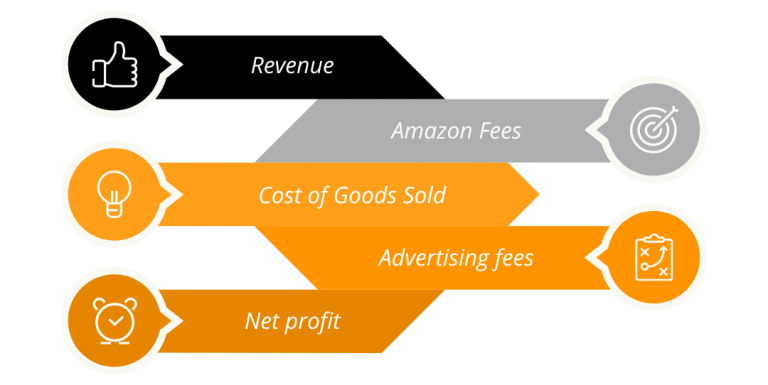

Outside of having your financials in order, you need to look into any expense that might be considered an add-back. These are expenses that are added to the profit of the business when it comes to price negotiation.

Rule of thumb: if it is a one-time cost or it will not be incurred ever again, it should be added back to the profit of the brand. Owner’s salary plus taxes, one-time marketing costs, and legal advisory to create company policies are all examples of add-backs you should.

Conclusion: Analyzing your FBA brand like a pro doesn’t have to be difficult.

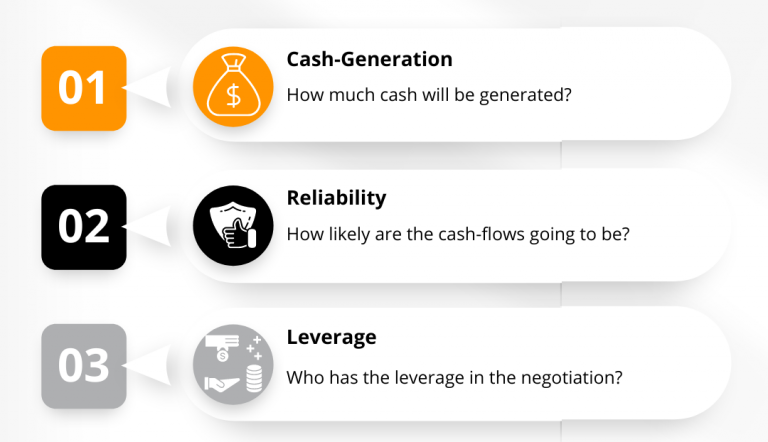

Like any other business valuation, it’s all about cash-flow growth and reliability combined with leverage while negotiating.

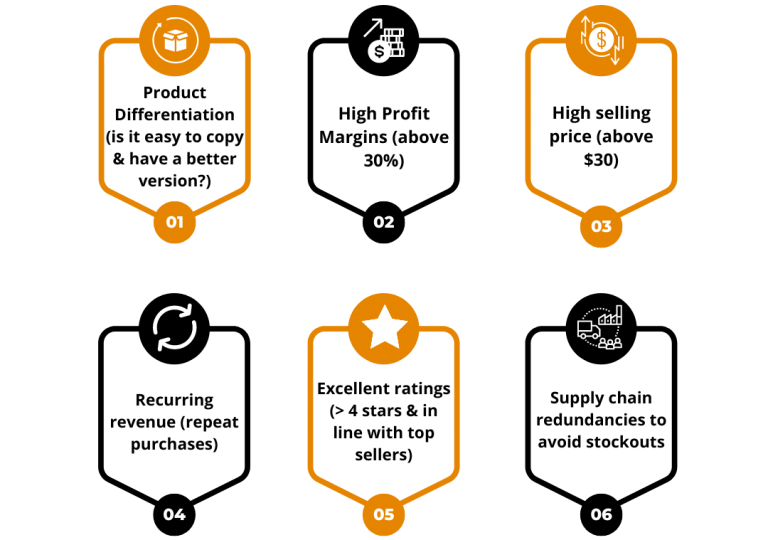

To evaluate your brand effectively, look at your listings and identify competitive advantages that allow you to maintain high-profit margins and no competition.

In your operations, make sure you never run out of stock by creating redundancies and being extra careful with inventory on hand. Additionally, make your business extra attractive by outsourcing every day-to-day activity you can.

Think about your brand outside of Amazon. Create a following by leveraging the platforms where your customers are.

Finally, do your financials housekeeping. Don’t skip on a good accountant and have every fluctuation explained.

And, in case you fancy a free business valuation, you may request it here: